Payroll tax formula

Our unbiased ratings of the Best Payroll Software of 2022 will help make that choice easier. 3 Factor sales property and payroll equally weighted.

Calculation Of Federal Employment Taxes Payroll Services

With warm appreciation for our loyal Payroll-Taxes users weve moved the Payroll-Tax content that you rely on and trust to better serve your payroll needs.

. The annual threshold is 1 million applicable from 1 July 2020. When the tax schedule changes all employers move to that tax schedule. Click cell C9 and multiply the net price in cell C8 by your sales tax rate by entering a formula such as C8005 for a 5 taxIf your tax rate is 8 enter C8008.

2 Ohio Tax Department publishes specific rules for situs of receipts under the CAT tax. It is usually managed by the accounting department of a business. Double wtd Sales 3 factors with sales double-weighted Sales single sales factor required if no specific business formula is specified.

Once you know the sales tax rate you need to collect at use the sales tax formula to calculate how much to charge the. This can be calculated using the following formula. 2022 Employer Withholding Calculatorxlsx.

Department of the Treasury. Amount to pay number of days appointed divided by total number of days in the month times tax. DOR has created a withholding tax calculator to assist employers in computing the correct amount of Kentucky withholding tax for employees.

Personal Tax Credits Return and the form TD1X Commission Income and Expenses for Payroll Tax Deductions. The Division of Revenue will approve an alternate formula that considers the allowable standard deduction and tax credits claimed by the employee using the tax rate schedule on the balance of. If you have a regular payroll period withhold the income tax on the basis of that period even though the employee does not work the full period.

These figures derive from a players payroll salary which includes the combination of a base salary incentives any signing bonus proration. Tax calculation formula for bonuses retroactive pay increases and other non-periodic payments. 3 New Hampshire will use a Single Sales Factor for tax.

Withholding Formula and Instructions. If you are on the payroll of the company then you will be treated as an employee of the company and will be eligible for gratuity as per the rules. Additionally IRS Notice 2020-65 allows employers to defer.

The 2022 CBT Threshold is 230000000. According to Notification no. The Nebraska Department of Revenue is issuing a new Nebraska Circular EN for 2022.

In 2020 an executive memo was released allowing employers to defer payroll taxes for employees. Cash Payrolls Luxury Tax Payrolls. For example you want to find the sales tax rate for Scottsdale Arizona.

How an employer is assigned a tax rate within a schedule. A real-time look at the 2022 Competitive Balance Tax payrolls for each MLB team. If a state is.

Individual employer tax rates depend on their experience rating or benefit ratio which measures the rate. Updated Tables effective January 1 2022 For use starting January 1 2022 Tax Table Instructions. When it comes to understanding payroll tax requirements at the federal state and local levels youre going to need to get comfortable with a few commonly used acronyms.

Arizona has a state sales tax of 56 Maricopa County has a county sales tax rate of 07 and Scottsdale has a city sales tax rate of 175 2022. 1213E dated 8th March 2019 the tax exemption limit has been increased up to Rs. Payroll is the sum total of all compensation a business must pay to its employees for a set period of time or on a given date.

Payroll services are offered by a third-party Webscale Pty Ltd the makers of KeyPay. WA Dept of Finance Payroll Tax Threshold in Western Australia. The amount deducted is utilized by state and federal insurance and medical services.

State copies of 2021 Forms. Form W-3N Due Date. Withholding Tax Information.

All tables within the Circular EN have changed and should be used for wages pensions and annuities and gambling winnings paid on or after January 1 2022. GST per month for each active employee paid using QuickBooks Payroll. For information on 2021 provincial or territorial personal amounts see the respective form TD1AB TD1BC TD1MB TD1NB TD1NL TD1NS TD1NT.

According to a tapering formula the threshold deductible amount of 1 million reduces by 2. Federal Unemployment Tax Act FUTA. First calculate the total amount to be deducted and withheld under the payroll formula.

View 2021 Withholding Tax Tables. QuickBooks Payroll is only accessible via QuickBooks Online subscriptions. Finding a payroll software for your business can be tough.

Electronic Reporting of Wage Statements and. 20 lakh from the former ceiling of Rs. 2022 Employer Withholding Tax Calculator.

The calculator was developed in a spreadsheet format so employers may use it for multiple employees. Medicare It is an additional payroll tax deduction that is mandatory and unlike social security taxes there is no base limit for deducting the Medicare taxes. Provide AmericanBritish pronunciation kinds of dictionaries plenty of Thesaurus preferred dictionary setting option advanced search function and Wordbook.

Oregons tax structure is self-balancing with two major parts. Or consult a tax professional or payroll provider about making payments for you. Some pre-tax deductions reduce only wages subject to federal income tax while other deductions reduce wages subject to Social Security and Medicare taxes as well.

QuickBooks Payroll powered by KeyPay. For example the exemption may apply to wages paid or payable for a 28 week period of maternity leave if the wages are paid at half the rate at which the wages would normally be paid or payable to the employee. Press Enter and the amount.

You will be charged 500 incl. This is a payroll tax that goes into a fund used at the federal level to oversee state unemployment insurance programs. Team Payrolls Cash Payrolls.

Employers who chose to defer deposits of their share of Social Security tax were required to pay 50 of the eligible deferred amount by December 31 2021 and the remaining amount by December 31 2022. Online Payroll Tax provides a wage breakdown function which automatically totals the wage payments that constitute either taxable or exempt wages and calculates the amount of tax payable. The Electronic Federal Tax Payment System tax payment service is provided free by the US.

Whether its gross-to-net calculations federal and state-specific tax rates the latest payroll insights or a payroll solution that you seek our hope is that you will find it at. IRS Publications 15 and 15-B explain which benefits are pre-tax for various purposes and professional-grade payroll software will help you keep track of all tax-related calculations. Gratuity calculation formula.

Movement between eight tax schedules. After youve enrolled and received your credentials you can pay any tax due to the Internal Revenue Service IRS using this system. Paid maternity leave parental leave and adoption leave up to a maximum of 14 weeks full pay is exempt from payroll tax.

Income Tax Withholding Reminders for All Nebraska Employers Circular EN. A real-time look at the 2022 payroll totals for each MLB team. MLB Team Payroll Tracker.

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Excel Formula Income Tax Bracket Calculation Exceljet

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Federal Income Tax

Payroll Calculator With Pay Stubs For Excel

Payroll Tax Calculator For Employers Gusto

How To Calculate 2019 Federal Income Withhold Manually

Payroll Calculator With Pay Stubs For Excel

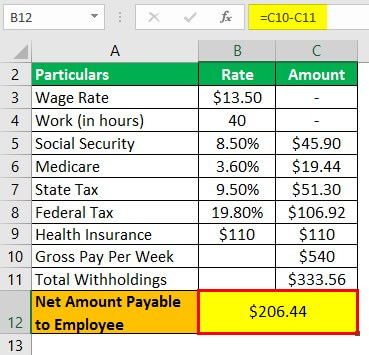

Payroll Formula Step By Step Calculation With Examples

Payroll Formula Step By Step Calculation With Examples

How To Calculate Federal Withholding Tax Youtube

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator Take Home Pay Calculator

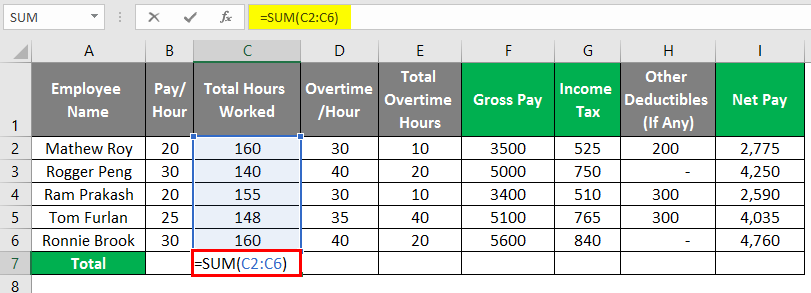

Payroll In Excel How To Create Payroll In Excel With Steps

Calculation Of Federal Employment Taxes Payroll Services

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Formula Step By Step Calculation With Examples

Komentar

Posting Komentar